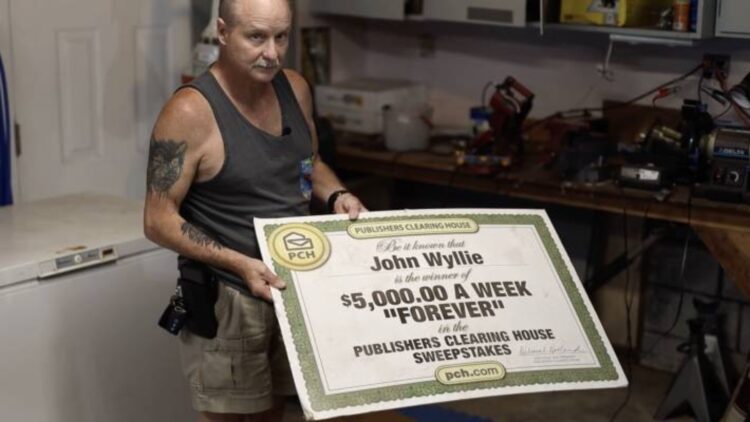

Never winning a prize has cost a winner so dearly. This was the case of John Wyllie, a 61-year-old man from Oregon who received a $5,000 per week prize for life from the Publishers Clearing House Prize Patrol in 2021. With this prize, he was able to retire and buy a house in Bellingham, Washington, United States. The problem arose when the company declared bankruptcy and, without prior notice, stopped issuing the checks.

Analysts blame fierce competition from companies like Amazon, along with an $18 million agreement with the Federal Trade Commission, as responsible for PCH’s disastrous outcome. In this situation, there is little affected individuals can do, but if you win a prize or a lottery, your priority should be to protect your financial security by creating a plan that ensures your economic stability.

What could go wrong?

Perhaps the winners of these prizes now regret having been the lucky ones. This is the case of John Wyllie, a 61-year-old man from Oregon, one of the fortunate ones who won a $5,000 per week prize for life! The prize came from the Publishers Clearing House (PCH) Prize Patrol in 2012. According to NBC KGW8, with the annual check of $260,000, Wyllie was able to retire and bought a house in Bellingham, Washington. With such an amount of money coming into his account every month, what could go wrong?

This went wrong

Well, what went wrong was that PCH collapsed. After experiencing a decline in revenue following the COVID pandemic, the fierce competition from Amazon, and the $18 million Federal Trade Commission settlement, it led to its total bankruptcy. If the company was bankrupt, what happened to the checks? They stopped arriving suddenly and without prior notice, affecting the winners’ finances. Wyllie’s case is just one of the 10 winners with pending prizes. According to statements to KGW8 by University of Oregon Law Professor Andrea Coles-Bjerre, “it is unlikely that the winners will be able to collect their winnings. They will be considered unsecured creditors competing for money that simply does not exist”.

How can I prevent this from happening?

What happened with PCH is a clear example of one of the worst-case scenarios that can occur. That is why if you win the lottery, a cash prize, or receive a large sum of money, you should prioritize protecting that gain. To achieve this, you can follow some of the following tips.

- Don’t tell anyone! As long as you don’t want to attract unwanted attention. Experts recommend creating a ‘living trust’ to protect your privacy and money.Assemble a legal team. According to John Jennings, president and chief strategist at ArchBridge Family Office, it is advisable to hire a financial advisor and an estate lawyer.

- Consult an advisor. It is important to seek advice before choosing between an annuity or a lump sum. Taxes and savings. Rachel Burns, a financial planner, told Forbes that having a certified public accountant (CPA) is helpful for designing a tax strategy.

- Paying off debts. Although receiving a prize may make our imagination wander toward expensive whims and unnecessary purchases, experts recommend taking care of debts first.

- Looking toward the future. It is important to think long-term, and companies like Trust & Will, which specializes in estate planning, recommend creating an emergency fund with at least six months’ worth of living expenses. It is also important to set aside some money for retirement.

- Make a will. Although no one wants to face that moment, experts recommend drafting a will and keeping it up to date, especially when receiving a large sum of money. It is important to set a clear and legally binding plan so that those of your choice benefit from your assets on the day you are no longer here.