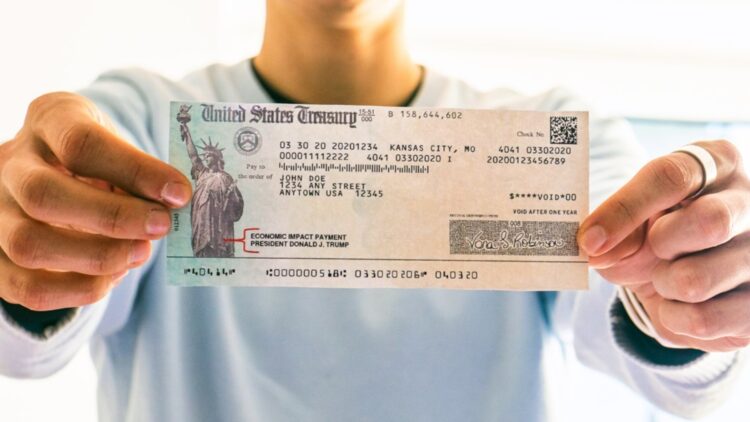

The Halloween season is arriving, the lead-up to Christmas, and the time when you could be eligible to receive a payment that would help you cope with all the expenses that are coming. We are talking about one-off stimulus and rebate payments, which are related to the tax season and the period of severe economic recession the country is going through. Some examples of these incentives are the “Trump Account” or the Alaska Permanent Fund Dividends (PFD).

In the case of the state of Virginia, it extends these stimulus programs to the entire population, not just the most vulnerable people, with the goal of reaching as many people as possible. According to Glenn Youngkin, Virginia has been able to link the state surplus with an increase in employment. To be able to access this tax refund, the requirements imposed by the Virginia Department of Taxation include that taxpayers have filed their tax return before November 3, 2025, and do not exceed their state tax liability after applying all deductions and credits. Payments are expected to be made in November as a single payment.

Economic Stimuli

Halloween, Thanksgiving and Christmas season is approaching, so receiving some extra help wouldn’t bother anyone. However, the period for stimulus payments and one-time rebates is also coming up, associated with the impulse-buying season and a period of serious economic recession. When filing taxes, it is possible to reduce overall tax liability through applying for deductions and tax credits.

Depending on the type of credit requested, one may receive cash payments. Some examples of one-time stimulus payments come from the government, such as the “Trump Account,” included in the approval of the “One Big Beautiful Bill,” intended to support parents with a child born between January 1, 2025, and December 31, 2028. Another example of a program provided by the local government is the annual payment to residents, as happens with the Permanent Fund Dividends (PFD) in Alaska.

Tax refunds in Virginia

As a general rule, stimulus programs and one-time discount checks are usually aimed at people considered to be in the most vulnerable situations. However, in Virginia they expand the scope, with the idea of reaching the largest number of citizens. This year, 2025, the refund in this state can reach up to $400, to which Governor Glenn Youngkin declared, “My friends, there is no reason to raise taxes on Virginians. We are running surplus after surplus after surplus”.

According to the data, the surplus achieved in Virginia thanks to local economic growth has reached $10 billion in the past four years. In response to this, Youngkin stated, “The strong job growth in Virginia, supported by corporate investment commitments of $140 billion, has generated a total of $10 billion in excess revenue and enabled a record tax reduction of $9 billion”.

What are the requirements to receive the $400?

The amounts vary depending on whether the application is for an individual or a couple, being $200 and $400, respectively. To receive these payments, two requirements must be met:File your Virginia state tax returns by November 3, 2025.Do not exceed your actual state tax liability after applying all deductions and credits. This will be possible as long as the state income tax deadline is met.For the next fiscal year 2025/2026, an increase in the Virginia standard deduction for singles and married couples is expected, and the earned income tax credit is also expected to increase the refundable portion from 15% to 20%.