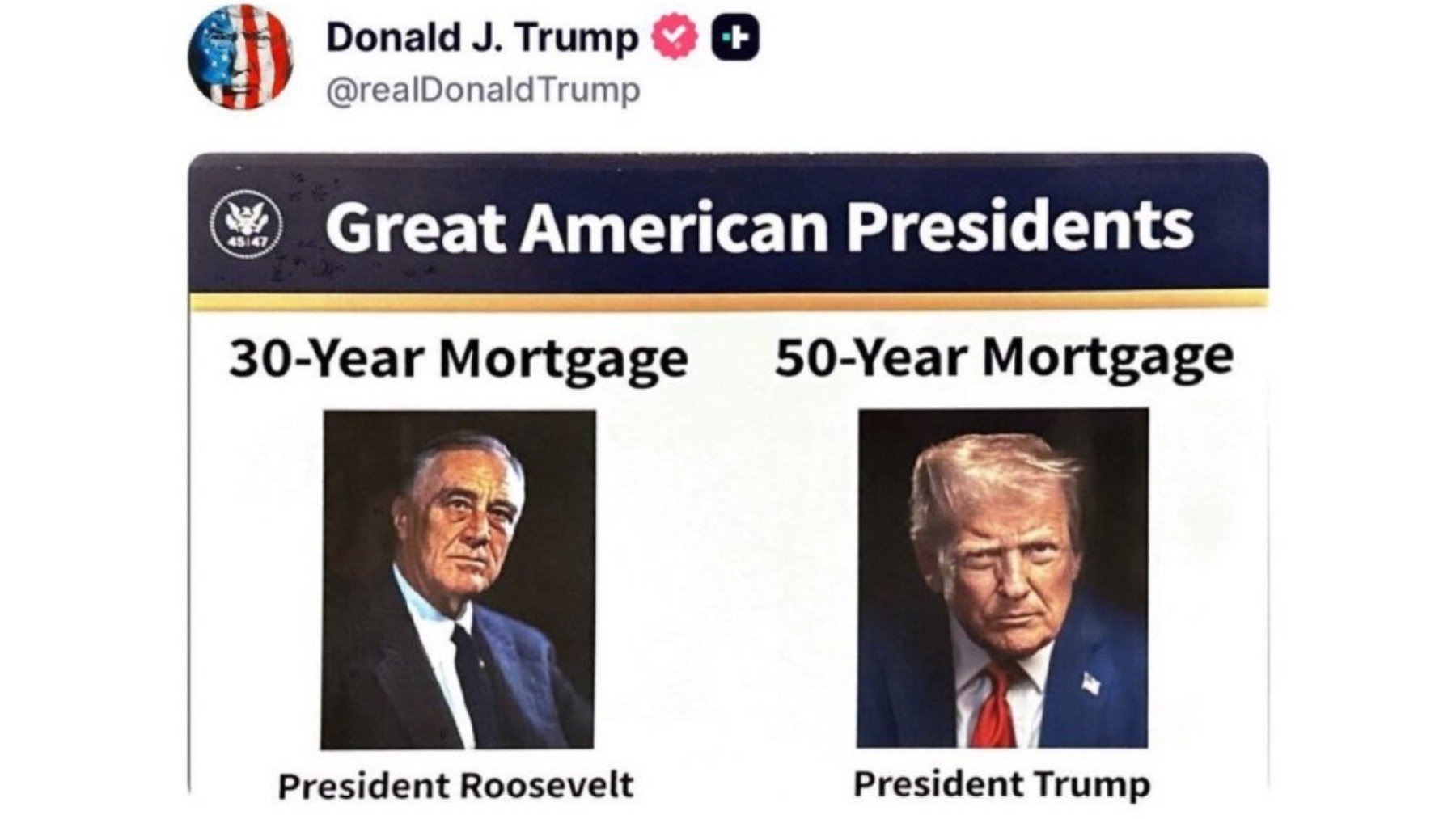

Donald Trump wanted to announce his new proposal in a more visual way (which is not surprising). In a post on Truth Social, he shared a post showing an image of himself next to former President Franklin D. Roosevelt. Above Roosevelt’s image, he wrote “30-year mortgage,” and above his own, “50-year mortgage.” This is how he announced his new proposal aimed at addressing the difficult real estate market facing the country. The director of the Federal Housing Finance Agency, Bill Pulte, confirmed these plans on his profile on the social network X. These types of 50-year fixed-rate mortgages are not covered under the Qualified Mortgage rules established by federal law, which means they would require prior approval from Congress.

According to Crypto Wendy, a popular cryptocurrency analyst on X, these new mortgages would provide more financial flexibility to buyers. However, Joel Berner, senior economist at realtor.com, stated that the longer the mortgage, the greater the amount of interest, which was supported by Freddie Mac. On the same side, Lawrence Yun, chief economist of the National Association of Realtors, highlighted the difficulty in building equity, even generating negative equity, which was supported by the Federal Reserve Bank of St. Louis.

Real estate market in the US

Buying a house in the United States is becoming an impossible mission due to high mortgage rates, low inventory, and record home sale prices. In addition, the average age of first-time buyers is 40, which represents a sharp increase compared to previous years. In response to this situation, Trump has proposed his solution: he has suggested 50-year mortgages. He did this through the social network Truth Social, where he posted a photo of himself alongside former President Franklin D. Roosevelt.

Above the image of the former president, it read “30-year mortgage”, and above his own, “50-year mortgage”. The director of the Federal Housing Finance Agency, Bill Pulte, stated, “Thanks to President Trump, we are actually working on the 50-year mortgage—a complete game changer”.

What would the existence of this type of mortgage imply?

First of all, it’s important to remember that this type of 50-year mortgage is not allowed under the Qualified Mortgage rules established by federal law, so it would first need to be approved by Congress. If approved, there have already been voices both in favor and against, highlighting the possible consequences. According to calculations by Richard Green, a professor at the University of Southern California on LinkedIn,

“if mortgage rates were 6.5%, a 50-year mortgage would cost $564 for every $100,000 of mortgage, compared to $632 for every $100,000 on a 30-year loan”.

Meanwhile, Crypto Wendy, a popular cryptocurrency analyst, said, “I don’t think a 50-year mortgage is bad. It gives everyone more financial flexibility. You can pay off a mortgage early. I’m not sure how to lower housing costs in 2025″. However, true specialists in the real estate world have spoken up about this, pointing out that taking out a 50-year mortgage would result in lower monthly payments, but a much higher total interest. According to Realtor.com senior economist Joel Berner, “The longer the life of the loan, the higher the compensation the lender will demand”.

What would happen with the profits?

Profits in another aspect, something to keep in mind when applying for a mortgage. The more years the mortgage is set for, the slower the pace at which homeowners would build equity. This is because experts suggest that the amount of interest paid to lenders would be 40% higher with this new type of mortgage. According to Lawrence Yun, chief economist at the National Association of Realtors, who told Realtor.com, “The slow equity buildup would make trading up or down very difficult. It would also take almost 40 years to pay off half of the balance, which means that most borrowers wouldn’t start building significant equity until the last decade”.

The St. Louis Federal Reserve Bank also stated that “Negative equity is a necessary condition for default. Otherwise, households would sell their homes, pay off their mortgages, and keep the remaining funds”.