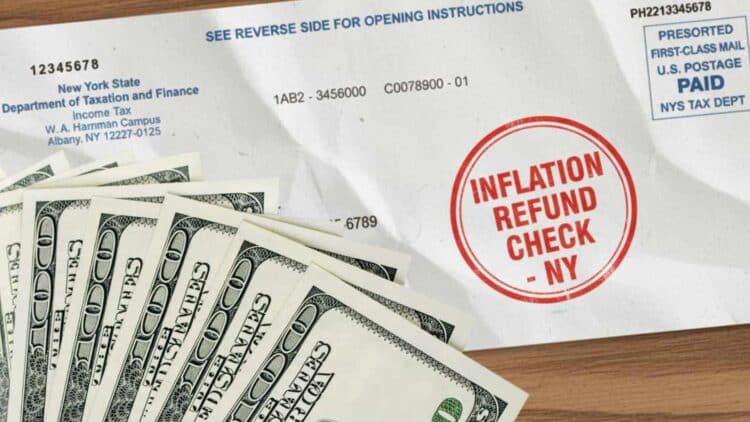

Inflation is undoubtedly a problem from which no state in the United States is exempt. In the case of the State of New York, payments of inflation relief checks amounting to $400 have been scheduled to help ease the financial situation of eligible New Yorkers. They began being issued last September, so if you have not yet received yours, you should contact the Personal Income Tax Information Center at 518-457-5181.

If you need a replacement check, you will need to complete forms DTF-32 and DTF-36 and submit them within the deadline. To be eligible to receive this tax refund, you must fill out form IT-201, known as the New York State Resident Income Tax Return, and submit it to the New York State Department of Taxation and Finance. If you have already submitted your application, you just need to wait for the money to arrive by mail at the registered address.

Measures against Inflation

Inflation is affecting all citizens of the United States, and the state of New York is no exception. For this reason, the New York Department of Taxation and Finance has launched the payment of so-called inflation checks, with the aim of alleviating the delicate economic situation of New Yorkers. Their issuance began last September, but if you have not yet received one, you should contact the Personal Income Tax Information Center at 518-457-5181.

Additionally, if a replacement check is needed, you must complete forms DTF-32 (notice to owner of a non-cashed check) and DTF-36 (request for a non-cashed check) and submit them before the indicated deadline. These checks are issued by the New York Department of Taxation and Finance and come from the New York State Budget for 2025-2026.

Eligibility criteria for the “inflation checks”

With an amount of $400, these checks require meeting a series of requirements. To be eligible, it is mandatory to fill out Form IT-201, that is, the New York State Resident Income Tax Return, and submit it on time to the New York State Department of Taxation and Finance. Each category has a threshold that must not be exceeded in order to be eligible:

- Married joint filers or couples with incomes below $150,000 will receive $400 checks.

- Joint filers earning between $150,000 and $300,000 will receive $300.

- Single individuals earning less than $75,000 will receive $200.

- Single individuals earning between $75,000 and $150,000 can expect $150.

The receipt of checks is not subject to regions or postal codes, so you may receive your check before or after your neighbor. Additionally, there are no age limits to apply and be eligible, so all family members can apply.

What should I do if I have already submitted my application?

According to officials from the state of New York, if you have filled out the corresponding forms and submitted the application correctly, you just have to wait. The money will be sent by mail to the registered address, so you must ensure that the information is up to date. If you have changed your address, you should contact the New York State Department of Taxation and Finance to update the information.

These checks of up to $400 provide significant help and relief for New Yorkers given the delicate situation faced not only by the State of New York but by the entire country. The use of the money is personal, so it can be used to cover upcoming holiday expenses or contribute to the much-needed savings in this uncertain scenario.